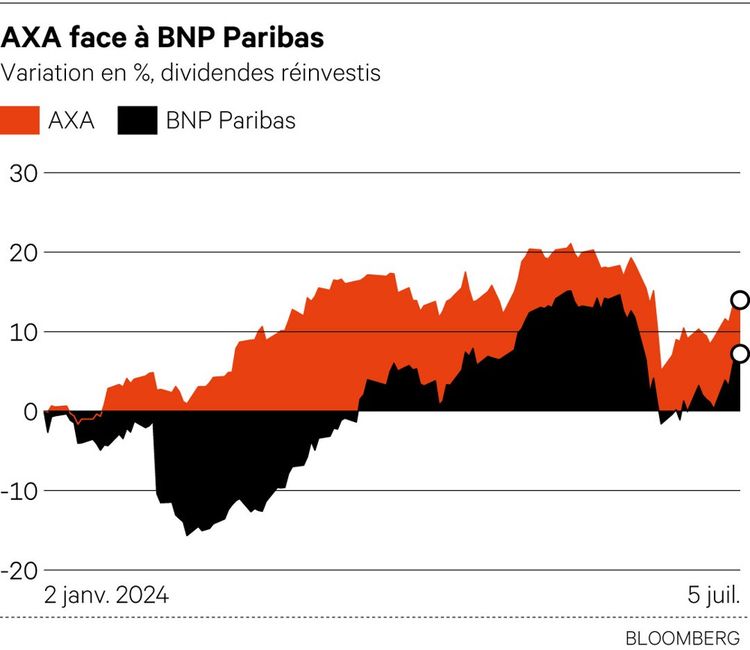

He who does not advance, falls behind. The old French proverb won’t necessarily be enough to bring together AXA Asset Management and BNP Paribas, but it does make them wonder if the game isn’t worth it. Because the evolution of passive management, the dynamics of non-listed assets and the complexities of sustainable management have not finished reshuffling the cards, let alone AI.

According to a McKinsey study, the operating margin gap between the first and last quarters of European management companies increased by ten percentage points between 2018 and 2023. While the economies of scale are well known, the risk of losing assets or talent is not negligible. Even UBS sees it through Credit Suisse.

BNP Paribas is integrating this business into its diversified business model, which takes into account the increased opportunities since the sale of Banque du West. Credit Agricole (Amundi) and BCE (Natixis IM) are posting higher assets under management, and so is Deutsche Bank.

Growth Deposits

At AXA, the question of controlling this core insurance know-how remains sensitive. Asset management accounts for a larger share of Allianz’s operating profit, thanks to its US subsidiary PIMCO. But the focus on property insurance has had the advantage of making the French competitor less dependent on the vagaries of financial markets.

However, the latter does not discourage the Italian company Generali, which has just achieved 20% growth through the acquisition of Conning Holdings. The challenges of aging and retirement are still seen as opportunities for growth.

Double-Axa“Echoes”

For blogging

AXA had €858 billion of assets under management at the end of March, compared with €562 billion for BNP Paribas’ “Asset Management” line. If we add insurance, wealth management and real estate, the bank manages a total of €1.282 billion. Generali is increasing its assets to €803 billion (figures at the end of 2023, including wealth management) with Koning, which strengthens its institutional management on behalf of third parties. At the end of March, Allianz had €2.297 billion of assets under management, including €1.784 billion on behalf of third parties.

“Tv geek. Certified beer fanatic. Extreme zombie fan. Web aficionado. Food nerd. Coffee junkie.”