Monday, December 4, 2020

Get the morning summary delivered directly to your inbox every Monday through Friday at 6:30 p.m. Registration

The risks that no one has talked about will cause more market damage

When investors think Where the stock market goes In the future, they may also be wondering what might go wrong.

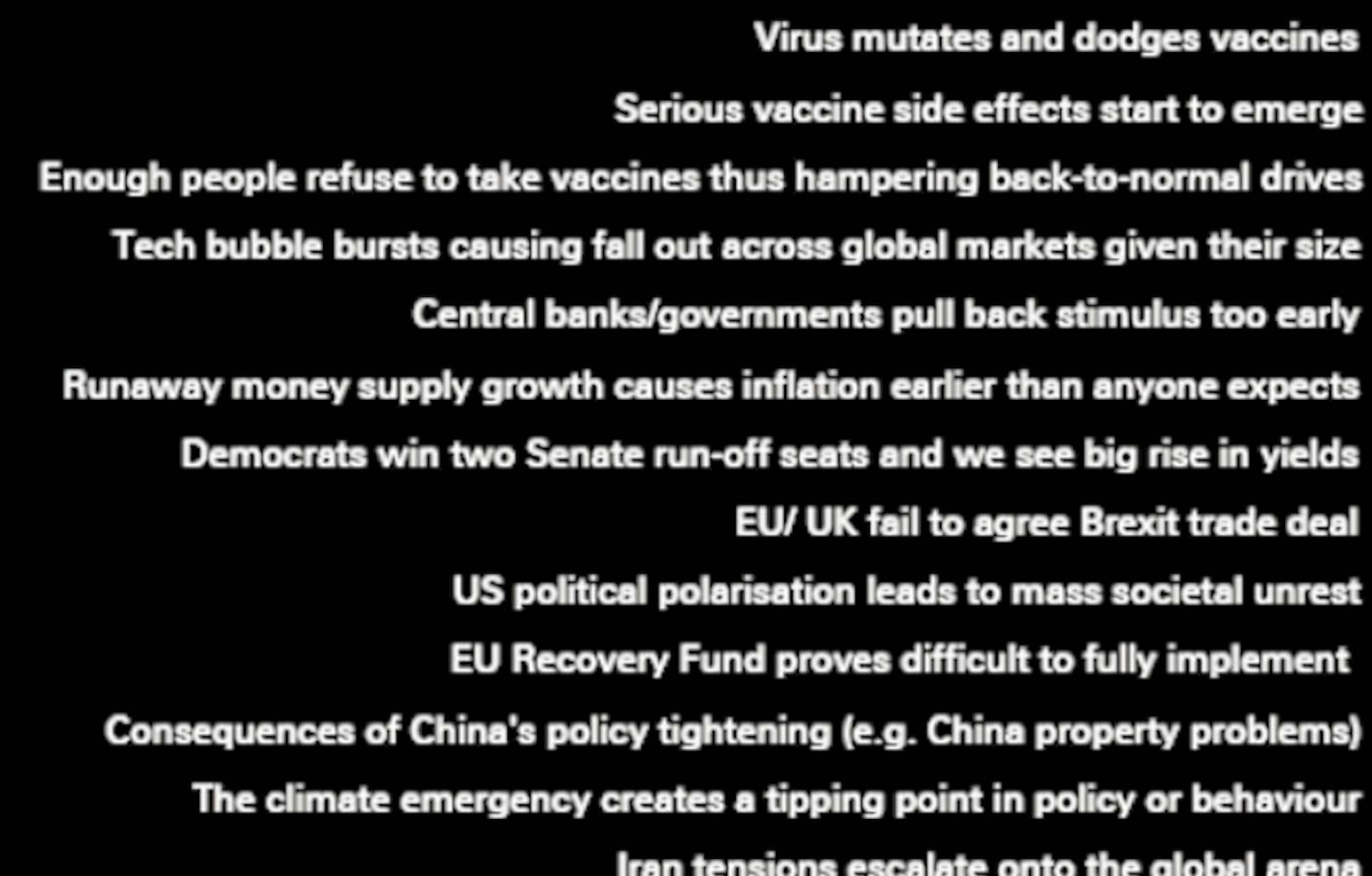

In a new monthly survey, Deutsche Bank asked its customers to “identify what they consider to be the biggest risks to global financial markets by 2021.” The company provided a list of options for respondents to choose from.

“Interestingly, all concerns about the vaccine fill the top 3, although while this is a good consensus for 2021, a successful vaccine release will still come as a surprise in relation to expectations,” Deutsche Bank strategist Jim Reid said Friday.

In fact, though, investors can count on something Is expected Will happen In fact Occurrence, the small amount of uncertainty, will prevent that event from being fully priced in the market.

Conversely, you could say that the items identified in the table above may be somewhat ready for investors to misbehave.

But what about the risks that are not covered here (or what <5% of people who answered the question said "none of these")?

Well, unrecognized risks are often classified as highly unlikely because they are incapable of giving much thought.

Unfortunately, unidentified risks can cause more damage when they are effective. Consider 2020. By this year, some may have imagined that we would face a global epidemic that would force large areas The economy must stop. It is this lack of expectation that leads to taking this risk to a lower price in the market, so it happens The stock market will fall As it did.

To be clear, we do not recommend that investors start thinking about potential risks. If investors are always too worried about everything that could go wrong, risky assets like stocks will never be enough.

However, investors need to understand that Unexpected events happen And this The stock market crashes Each time at a time.

The good news is that the stock market has a steady record Recovers vertical losses And mobilization for new records. So, investors Time to invest Don’t skip stocks for fear of the next crash, but remember that In the short term things can go wrong And Can offer the opportunity to purchase.

Issued by Sam Roe, Executive Editor. Follow him on Am Samro

What to see today

Economy

Revenue

The best news

‘Creative’ Brexit talks and US vaccine rollout lift stocks [Yahoo Finance UK]

U.S. agencies hacked into global cyber spying campaign [AP]

Exports of the COVID-19 vaccine begin with a historic U.S. initiative [AP]

Elliott buys shares in public stock [Bloomberg]

Yahoo Financial Highlights

The analysis argues that the United States needs a $ 4.5 trillion stimulus to recover

Senator Warren: ‘We need to cancel student loans widely’

LA Dodgers Co-Owner: Infection does not affect pro-license values

–

Follow Yahoo Funding Twitter, Facebook, Instagram, Flipboard, SmartNews, Center, Web light, And reddit.

Find live stock market quotes and the latest business and financial news

For tutorials and information on tutorials and trading stocks, see dinner

“Beer practitioner. Pop culture maven. Problem solver. Proud social media geek. Total coffee enthusiast. Hipster-friendly tv fan. Creator.”