N26 updates your app for iOS and Android.

DrBerlin-based financial service provider N26 primarily targets private clients and the self-employed who can and want to do without traditional banks. Customers control and track various financial transactions via the app. To ensure these processes run more smoothly, N26 publishes updates on a monthly basis. This is also the case this month: On March 3, 2021, Al Mubasher announced current improvements and innovations.

Current account comparison: free or fee – overview

Monthly account fee?

Free gyrocard?

Girocard free partner?

Cash withdrawal fee via Girocard

Effective annual interest rate for permissible overdraft (overdraft facility)

Free credit card?

Fee for cash withdrawal by credit card in the machine

Free partner credit card?

Cashback program

The banking app

Google Pay and Apple Pay

The number of branches in Dr.

It is not 700 € of the money received per month, otherwise 3.90 € / month

And the

No

In Germany with a maximum of 6 withdrawals / month for free, then € 2; Outside Germany 1% of sales (at least 6 euros)

7,17%

In the first year, then only with a sales figure of at least 4000 EUR / year, otherwise 29.90 EUR / year

In Germany 2% (at least € 2.11); Free at the European Union level; Outside the European Union 1.75%

No

No

And the

Noor Google Pay

None (direct bank)

No

And the

And the

Free in Germany and the Eurozone, otherwise 9.90 €

6.66%

And the

9.90 euros inside the eurozone for free outside the eurozone

And the

Yes (Savings Bonus)

And the

And the

None (direct bank)

It is not 700 € of the money received per month, otherwise 9.90 € / month

And the

And the

Free in Germany, otherwise 1%

9,75%

No (€ 39.90 / year)

In Germany 1.95%, otherwise 1.95% + 1.75% + 0.59%

No

No

And the

And the

Which – which. 800

No

And the

And the

Free as an active client (AK), other than that outside the Eurozone 2.2%

6.65% as the AK, otherwise 7.25%

And the

Free as an active client, other than that outside the Eurozone 2.2%

And the

And the

And the

And the

None (direct bank)

It is not 700 € of the money received per month, otherwise 4.90 € / month

And the

And the

From 50 € free in Germany at 1,200 ING machines, otherwise operator fee, outside Germany € 5

6.99%

And the

From 50 € free in Germany and the Eurozone, otherwise 1.75%

And the

And the

And the

And the

None (direct bank)

No

And the

No

3 withdrawals per month for free in Germany and the Eurozone, then € 2; Outside the Eurozone overall 1.7%

8,90%

No credit card available

–

–

No, but partner offers

And the

And the

None (direct bank)

No

For a period of 12 months (then 24 € per year)

And the

Free worldwide from Dt-Bank and Cashgroup partners plus 12 free withdrawals from others, then at least € 6

10.85%

And the

In Germany 2.5% (at least 6 euros); Otherwise free of charge in the Eurozone; Outside the Eurozone 1.75%

And the

No

And the

nur Apple Pay

None (direct bank)

€ 1.90 / month

And the

No

In Germany with Postbank / CashGroup machines free of charge

10.33%

29.90 € / year

In Germany 2.5% (at least 5 €); Otherwise free of charge in the Eurozone; Outside the Eurozone 1.85%

No

And the

And the

No

Which – which. 4300

It is not 600 € of money received per month, otherwise 3.95 € / month

And the

No

Free in Germany at 3,200 machines; Otherwise 1% (at least € 5.95) outside Europe plus 2%

7.28%

And (Visa Online Classic)

With free credit in Targobank machines in Germany and the Eurozone, otherwise 3.5% (at least 5.95 €); Outside the Eurozone 1.85% + 2%

Yes (with Visa Online Classic)

No

And the

No

337

N26 Application: This is in the update

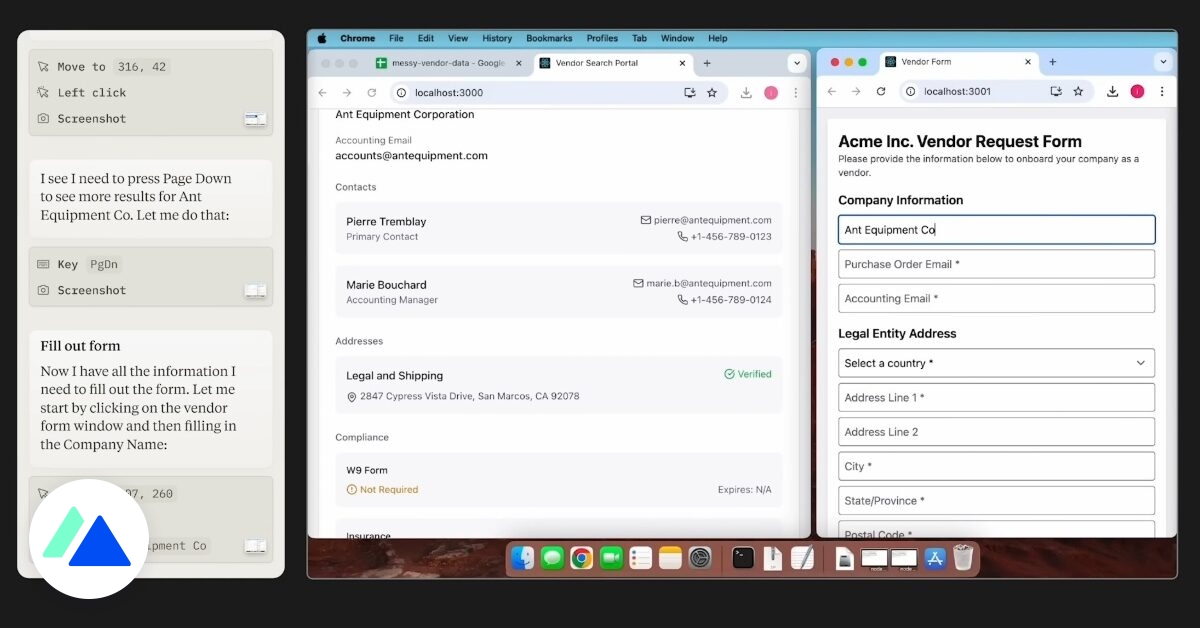

According to N26, the update comes with an expansion of the Statistics feature: The Monthly Budget Overview displays the categories of “Shopping,” “Eating and Grocery,” and “Bars and Restaurants” in a graph. There, users can see how much they are spending on each of these areas. The app also does a comparison with the average expenses for the past three months. You can now click on transactions related to another (such as credits). Sub-accounts, called Shared Spaces, can now be created more quickly. Users create a sub-account directly under the “Space is for …” menu item. If customers are tired of decimal places, they should like this new feature: Under the menu item Cards, they have the option to activate or adapt the rounding rule. Customers can now add cards to their Apple Wallet or Google Pay (Wallet) there. Turning through the map settings is history.

N26 app: update for iOS and Android

The innovations are already available in the web app and on Android and iOS devices. But not every N26 account model contains all of the new features. Faster creation of “shared spaces” is reserved for premium clients. The app is free at

App Store (iOS),

Google Play Store (Android) for download.

* Our independent experts deal regularly with products and service providers. We will provide you with the resulting articles free of charge. COMPUTER BILD receives a small commission if you click on a link or enter into a contract with an associated provider. Note: The content on computerbild.de is not a specific investment recommendation and contains only general information. The authors, editors and sources mentioned are not responsible for any losses that may arise through the purchase or sale of the securities or financial products mentioned in the articles.