Salesforce releases comprehensive e-commerce trends for the first time.

B2B and B2C e-commerce trends according to Salesforce.

As a sector still on the move, e-commerce has intensified further with the pandemic and new consumer behaviour. Salesforce surveyed 1,400 business executives, analyzing purchasing data from one billion consumers around the world to learn more about key e-commerce trends, consumer and professional expectations, the impact of e-commerce on sales teams or even developments in B2B commerce. So, a detailed study, with particularly extensive data, on which we present some lessons here.

The report consists of two parts, and takes a look at B2C first.

Blurring the boundaries between physical commerce and online commerce

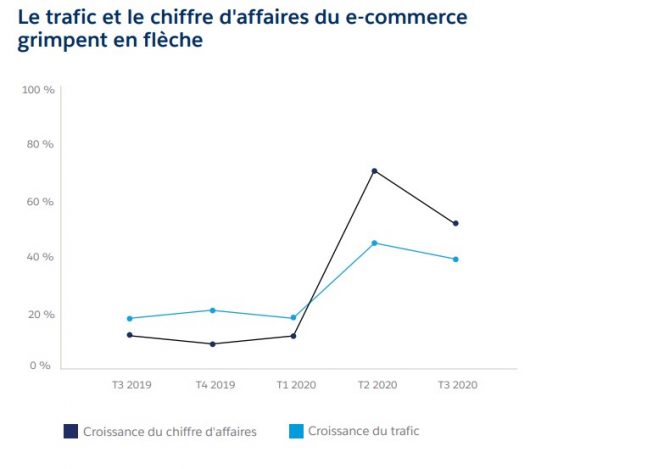

B2C business has been hit hard by Covid. E-commerce, which is experiencing constant growth, has taken advantage of events to speed up its pace. According to Salesforce and its analysis of the purchasing activity of one billion consumers, e-commerce revenue increased 75% in the second quarter of 2020, and by 55% in the third!

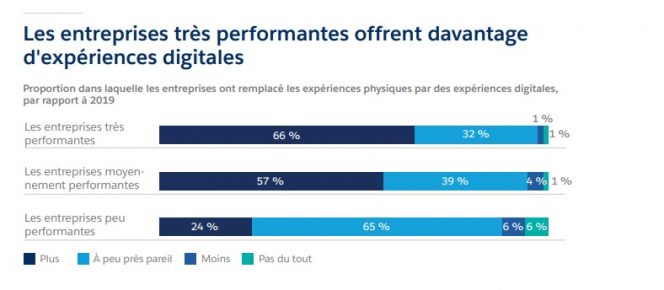

After Covid, many companies have reallocated a large part of their marketing and promotional actions towards digital. B2C companies have gone out to meet their customers, that is, online. Investments have been largely attributed to digital. Unsurprisingly, high-performing companies have been able to better manage this shift.

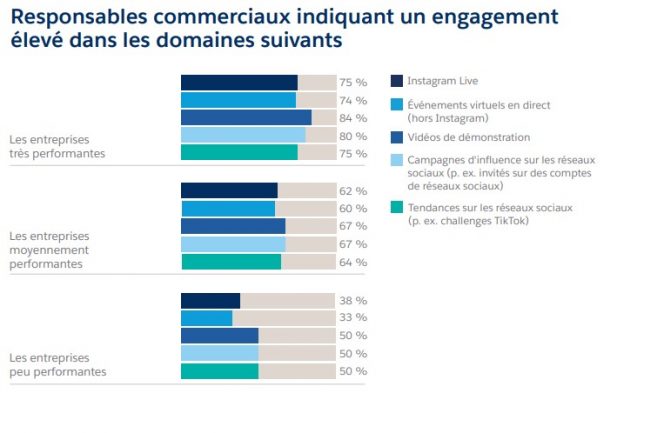

Tests of communication strategy have also multiplied to try to engage consumers in the absence of physical interactions. Among the content offered to customers: virtual events (Instagram Live), virtual shopping, instant messaging, live video, virtual reality and augmented reality.

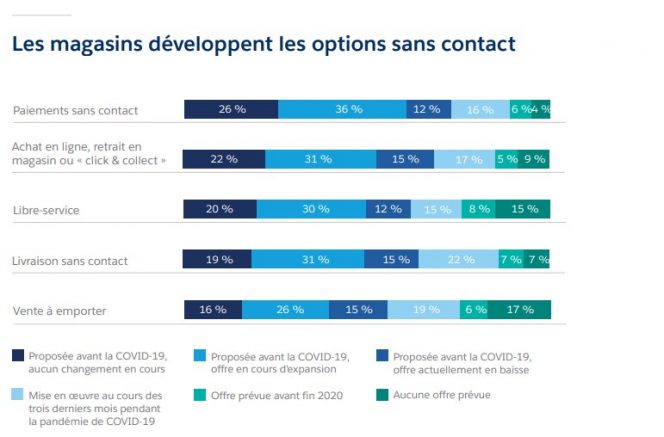

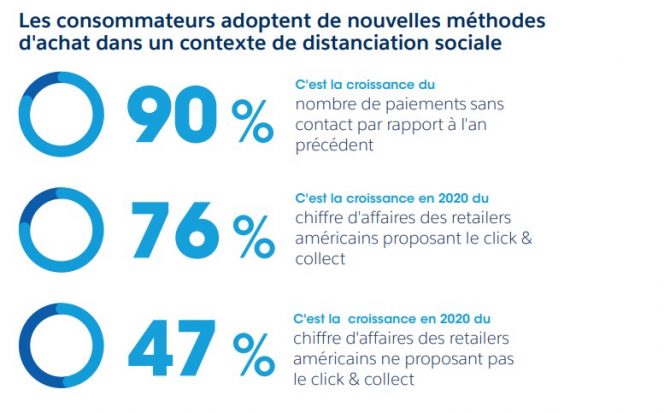

The pandemic has also been an opportunity to devise contactless strategies, or at least connectivity: contactless payment, click and collect, self-service, contactless delivery, or pickup. Home delivery is not always friction-free (missing packaging, delays, etc.) and thus the store remains an important asset of a good distribution strategy.

In general, two main trends have emerged: smartphone payments (and therefore contactless payment), and stores that have become a place for processing online orders.

Direct selling is gaining ground

Direct-to-consumer (D2C) sales are on the rise, even for consumer brands. Between March 2019 and March 2020, the increase in online purchases of essential goods was 20%!

With regard to agri-food, here again, manufacturers are increasingly replacing their in-store procedures with digital ones. And this paradigm shift in consumption is sure to be permanent: 68% of consumers say they will continue to buy essential goods online after the pandemic.

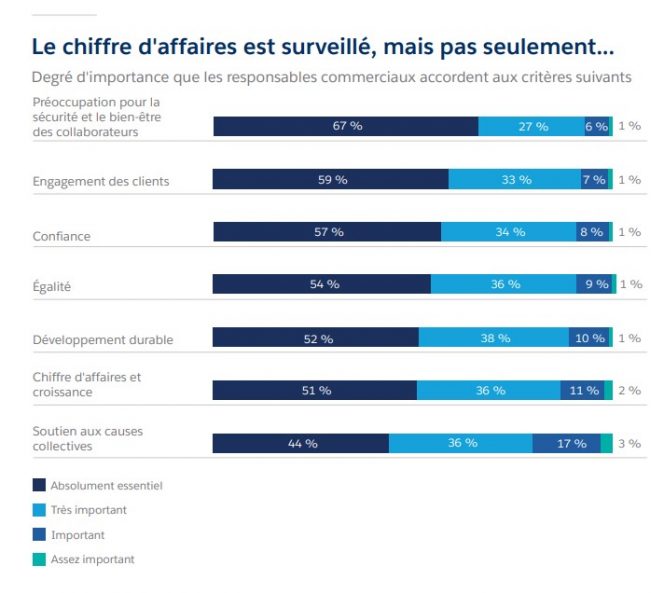

As for goals, turnover is clearly being monitored, but sales managers have other priorities, in particular employee safety. Customer engagement comes next and remains a major concern.

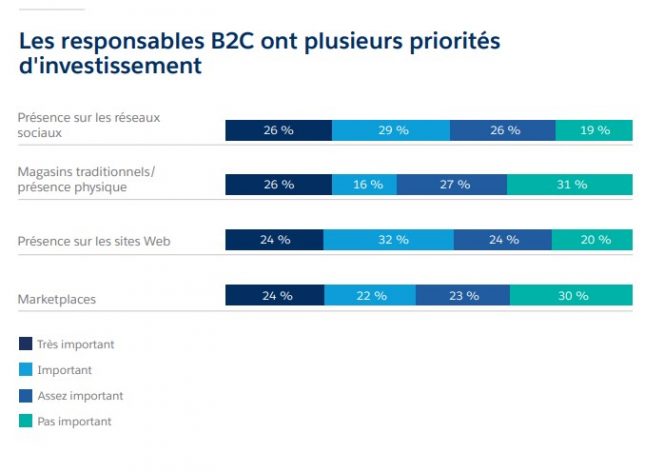

When it comes to investment priorities, B2C companies try to overcome the lack of first-party data as much as possible. In particular, this includes investing in various data collection channels: social networks, web presence, etc. In general, the most efficient companies focus their investments on web channels, while the least efficient prefer to invest in traditional stores.

Decentralized shopping acceleration

Salesforce is experiencing the emergence of “decentralized shopping”: the fact that brands are investing in multiple digital channels to sell their products directly there. Traffic on e-commerce sites, according to Salesforce, increased 104% in the second quarter of 2020. Traffic isn’t anecdotal, because it’s realized in purchases.

Most viewed content varies by region: Instagram Live and TikTok for China, Japan or Australia; Influencers campaigns in North America.

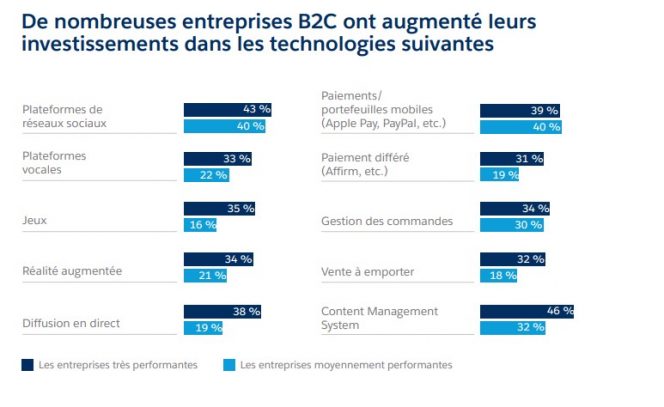

By increasing investments in new digital channels (video games, voice assistants, augmented reality, etc.) brands do not expect gains in notoriety. In fact, more and more channels offer contextual commerce that allows brands to approach their business challenges.

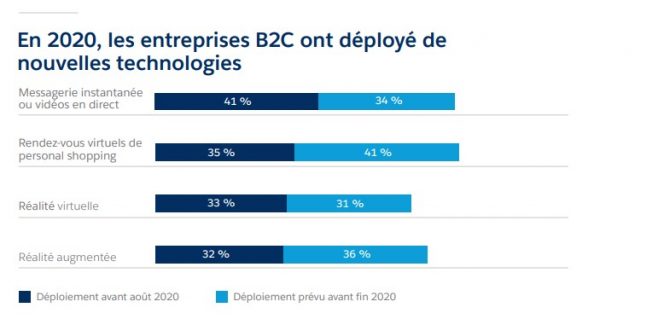

Salesforce also notes that B2C companies have adapted very quickly to the new challenges associated with the pandemic. In just 3 months, 41% of B2C companies implemented instant messaging or video chat services for their online offerings.

According to Salesforce, this pandemic has finally allowed e-commerce to continue to grow, but it hasn’t replaced the physical store! A store that was a place of discovery becomes, say, a place of delivery or payment, but it retains its full place in a business strategy.

The second part of the study looks at B2B e-commerce. Here again, Salesforce reveals several key underlying trends, and takes an in-depth study of how B2B companies are going digital. To learn more, you can download the full study for free from this link.

“Certified gamer. Problem solver. Internet enthusiast. Twitter scholar. Infuriatingly humble alcohol geek. Tv guru.”