Nvidia (NVDA) Recently announced its 3Q revenue on the back of a strong year. However, the company’s upcoming AMD and Intel competition, heavy multiplier and sluggish revenue growth compared to this multiple indicates that the company is overstated. As a result, as we see throughout this article, we expect its folds to contract to fix this.

Nvidia 3Q2021 Financial Results

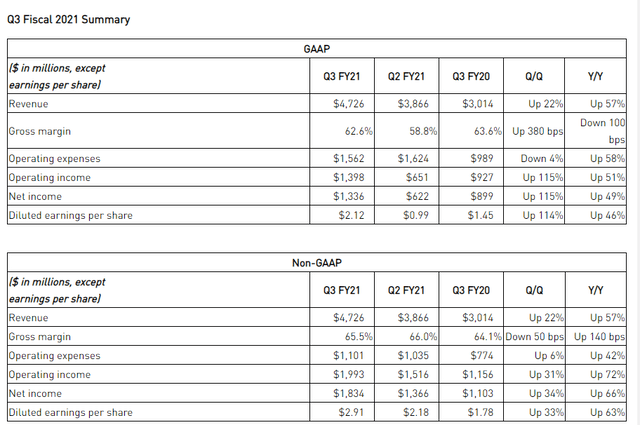

Nvidia’s 3Q 2021 financial results are very respectable, showing good growth in the company’s key business avenues.

Nvidia Revenue – Nvidia News Release

Nvidia’s 3Q 2021 revenue is just over $ 4.8 billion, up 57% from 22% on QoQ. It was backed by the company’s new 3070/3080 GPU launcher, the most important release for the company in many years. Despite a strong competitive product from AMD (AMD). The company has a total margin of more than 60%, resulting in a net income of more than $ 1.3 billion

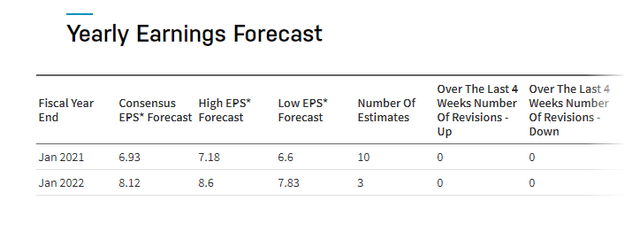

The company’s non-GAAP revenue is very low because the company is not one to drastically reduce its GAAP revenue. However, despite the continued strong earnings, with massive growth, the company’s GAAP EPS is only $ 10 / share per year. This will give the company a P / E ratio of more than 50x. That’s it The company’s historical P / E ratio is over 3x Before many inflation.

To be more pricing, Nvidia will need significant growth in an industry that will become increasingly competitive. Of AMD New top-end GPUs considered to compete with Nvidia’s GPUs. This is the first time in almost a decade. As customers focus more on separating themselves from the company, it is not defined whether it will achieve this growth.

Nvidia ARM acquisition

Another unique move by Nvidia is the $ 40 billion acquisition of ARM.

It remains to be seen whether this acquisition will pass, Desperate worries are incredibly significant. The acquisition is promising, and ARM is becoming increasingly popular, but the company is still there Sold to Nvidia at market capitalization with a sales rate of over 20. That is, despite the potential size of the acquisition, it will be long overdue until it creates valuable cash flow for shareholders.

Ultimately, the financial position is what investors bet on.

Nvidia growth potential

Investors in Nvidia need to justify the valuation, and the only reasonable way to justify the valuation of the company is to look at its growth potential. Most of Nvidia’s revenue comes from its “gaming” and “datacenter” businesses, and its datacenter business is growing particularly rapidly.

Nvidia GPU The accelerator market is projected to reach $ 30 billion in 2020 and $ 50 billion in 2023, many years ago. Here is an alpha article though, Discussed how they were Moonshot ratings. Further Realistic estimates reach $ 50 billion by 2026. However, competition is expected to increase significantly, Intel is now landing on the field.

With Nvidia’s growth ratings lagging behind, and competition, the company will see growth here that could double revenue, but with minimal long – term revenue growth potential.

The consensus is that Nvidia’s 2020 EPS ~ 8.1 / share will not be higher than its current EPS. I.e. traded at a> 50x p / e ratio, which would now be 2-3x years. The company can achieve long-term growth, but with 17% YOY growth, that is, until the mid-2030s when Nvidia achieves a reasonable estimate of its current share price.

Indicates how much the company is valued. Based on this, we will not be investors in the company at the present time. The company is a risk narrower due to the current high flying technology market, however in our view it is necessary to sell your investment to capture the latest gains in the company’s share price.

Thesis risk

In our view, the study risks for investing in Nvidia are based on how high-flying technology stocks have been recently. Numerous start-ups or medium-sized companies with “hip” technologies saw their share price rocket. Individuals chasing the next technology opportunity The value of Nvidia has more than doubled this year.

This ecstasy, reminiscent of technology markets of the late 90s, is hard to compete with. However, we recommend those who are lucky enough to invest in Nvidia to sell their shares and collect profits.

Conclusion

Nvidia has an interesting asset portfolio and the company continues to experience significant growth. The company’s YOY upgrades supported its EPS growth. However, in our view, the company is now highly valued and those lucky enough to invest should sell their shares to collect their rewards.

In our view, it is up to the mid-2030s for the company to reach a reasonable value based on its current share price. Another way to look at it is that the company is highly rated based on its current price and is subject to multiple contractions. For this reason, we do not recommend investing in Nvidia.

Energy Forum Helps to earn higher yields from the portfolio of quality energy companies. As global energy demand increases, you can be a part of this exciting trend.

Also read about our newly launched “Income Service”, non-departmental specific revenue portfolio.

Energy Forum Provides:

- Model portfolios managed to earn higher yields.

- In-depth dive research reports on quality investment opportunities.

- Macroeconomic market perspectives.

Disclosure: I / We have long been NVDA. I wrote this article myself and it expresses my own opinions. I did not receive compensation for that (except for looking for alpha). I have no business relationship with any of the companies mentioned in this article.

“Beer practitioner. Pop culture maven. Problem solver. Proud social media geek. Total coffee enthusiast. Hipster-friendly tv fan. Creator.”